The rapid expansion of blockchain ecosystems has resulted in a proliferation of distinct protocols, each with its own consensus mechanism, virtual machine, token standards, and community of users. While this diversity enhances innovation, it has also introduced a persistent limitation: fragmented liquidity. As each blockchain network operates in isolation, capital becomes siloed, and the inability to move assets freely between chains reduces efficiency, usability, and composability across the sector.

Addressing this challenge requires the development and deployment of secure, scalable, and decentralized cross-chain liquidity infrastructure, one that can coordinate liquidity and application logic across multiple networks without compromising user custody or introducing centralized risk.

What is Cross-Chain Liquidity?

Cross-chain liquidity refers to the ability to access and utilize capital across distinct blockchains through secure, trust-minimized mechanisms. It allows users to engage in cross-chain swaps, provide assets to cross-chain liquidity pools, and participate in lending, borrowing, and staking across diverse protocols, all without relying on custodial bridges or synthetic representations.

In practice, cross-chain liquidity works by linking assets and smart contracts across chains in a way that ensures cryptographic guarantees of execution. This enables seamless transfers of assets, facilitates complex cross-chain transactions, and provides unified access to liquidity pools deployed across varied blockchain ecosystems.

How Cross-Chain Liquidity Works

Achieving reliable cross-chain functionality involves a suite of technologies and design patterns, including:

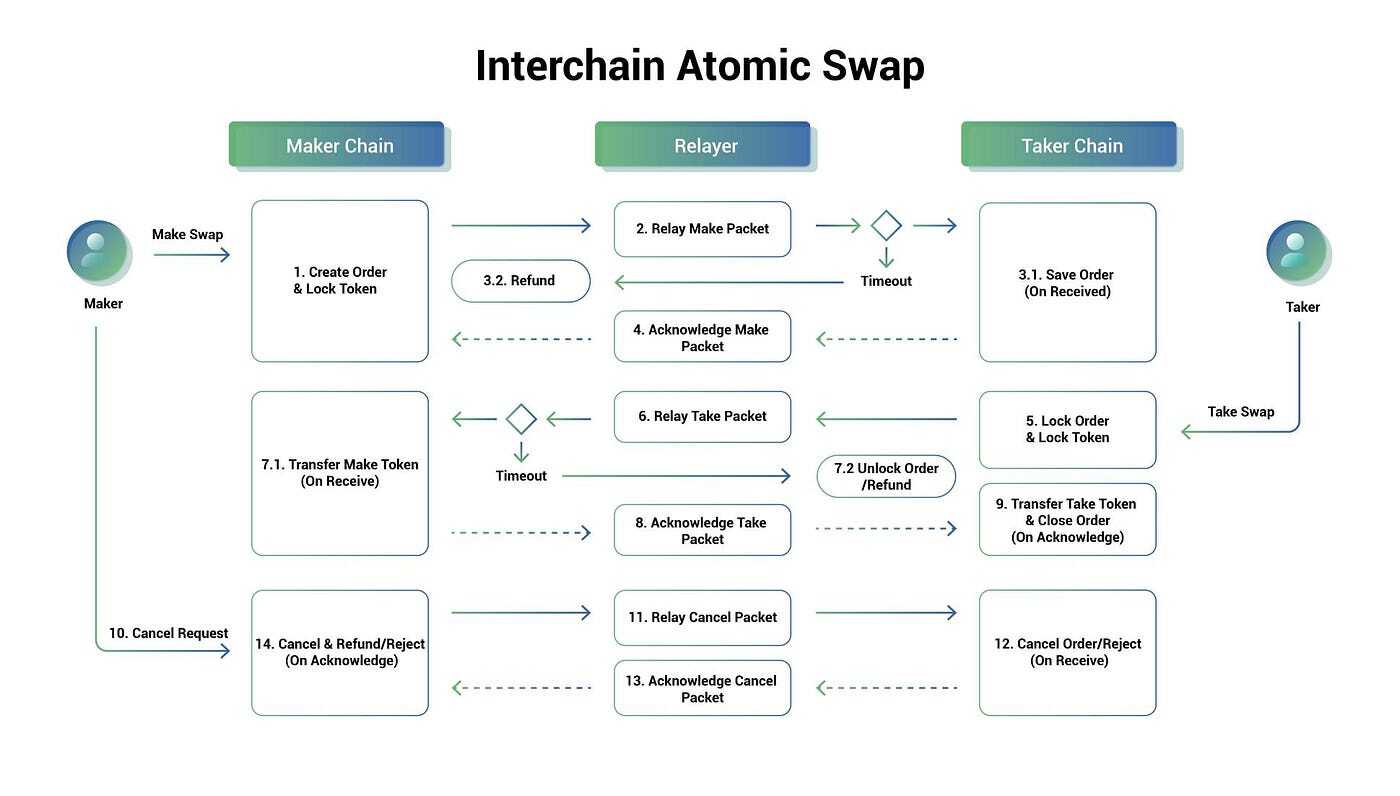

- Atomic Swaps: These enable two parties to exchange assets across chains without intermediaries. The process ensures either both transfers succeed or neither executes, preserving asset integrity and avoiding counterparty risk.

- Hash Time Locked Contracts (HTLCs): HTLCs are specialized smart contracts that lock funds until a predetermined secret is revealed, within a defined time window. This structure forms the basis of many trustless cross-chain swaps and is foundational in protocols like THORChain and Komodo.

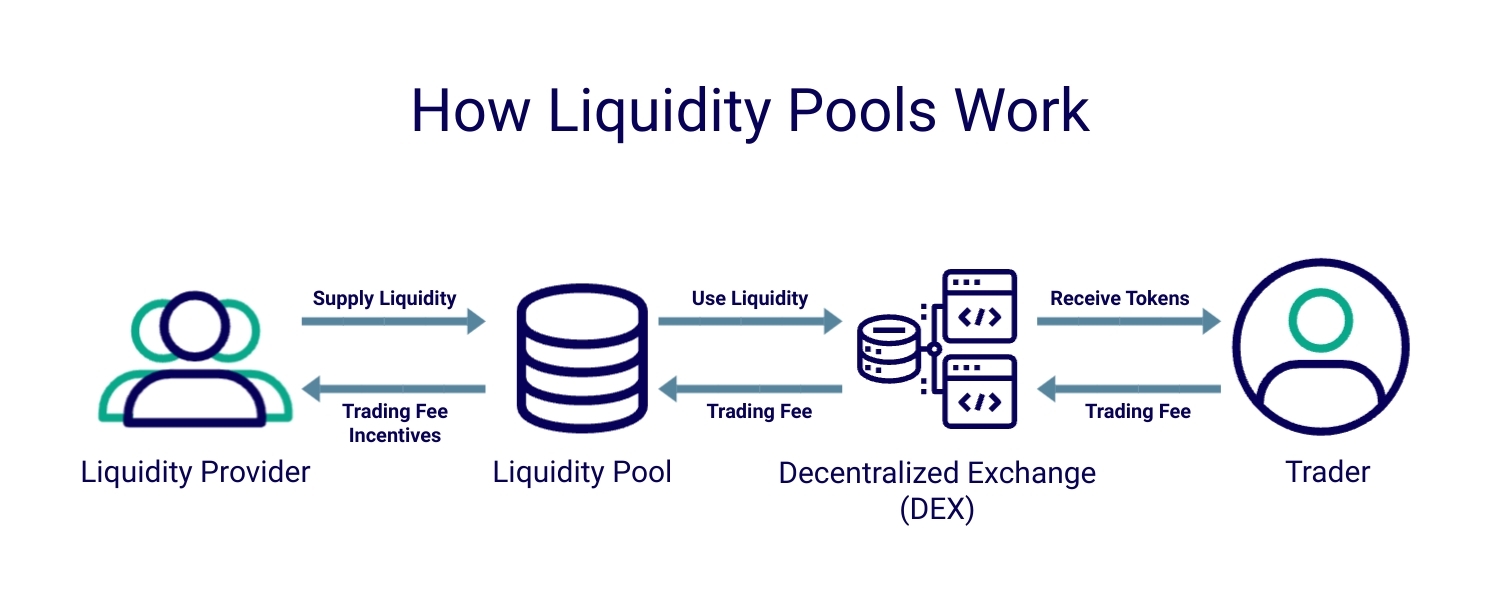

- Cross-Chain Liquidity Pools: These are distributed liquidity reserves deployed across multiple blockchain networks, facilitating direct participation in trading and yield generation across ecosystems. A cross-chain liquidity pool allows users to deposit assets on one chain and enable activity on another, typically coordinated by an interoperability protocol.

- Proof-of-Stake Validators and Relayers: To verify state changes and smart contract events across chains, many systems employ proof-of-stake (PoS) validator sets or decentralized relayers. These actors monitor block headers or state roots and submit cryptographic proofs to target chains, maintaining integrity across environments.

Alpha’s Contribution to Cross-Chain Liquidity

Alpha introduces a unique approach to chain liquid infrastructure by rejecting synthetic assets, wrapped tokens, and traditional bridges. Instead, Alpha establishes a multi-chain liquidity UX layer that enables developers and users to interact with staked assets on-chain while gaining composable access across chains.

Using native staking on chains like Sui, Alpha generates on-chain escrow objects when a user locks assets. These escrows are not pooled or bridged; they remain on the source blockchain network under smart contract control. Alpha then issues non-transferable Alpha Points, calculated based on validator selection, stake duration, and amount. These points represent composable, sybil-resistant reputation and value, which can be used for access, borrowing, or redeeming within supported applications.

This architecture allows Alpha to transfer assets conceptually by enabling cross-chain utility without requiring actual token movements. By eliminating wrapped tokens and centralized bridge risk, Alpha ensures security while enabling cross-chain application functionality.

Use Case: Cross-Chain Borrowing Without Transfers

To illustrate Alpha’s architecture, consider a user staking $SUI into Alpha’s escrow module. Over time, the user accrues Alpha Points. These points can then be used to borrow testnet $SUI on another chain or unlock gated access to dApps without transferring any tokens across chains.

This model maintains native-chain security and removes the complexity associated with cross-chain transactions. It also enables dApps to build on Alpha’s infrastructure and create incentives or access models that span multiple networks, all while remaining trustless and decentralized.

Strategic Advantages of Cross-Chain Liquidity

The strategic significance of cross-chain liquidity extends beyond user experience:

- Capital Efficiency: By aggregating capital across chains, protocols can reduce duplication and offer deeper liquidity pools to users and traders, enhancing the performance of decentralized exchanges (DEXs).

- Composability: Applications can execute business logic across chains without replicating code or liquidity, enabling more flexible deployment strategies and more responsive ecosystems.

- User Sovereignty: Users maintain custody of their assets and avoid the risk of bridge exploits, rehypothecation, or liquidity fragmentation.

- Protocol Interoperability: Protocols like Alpha make interoperability protocol design practical by standardizing the logic that governs how applications interact with escrowed capital and utility across chains.

Comparison with Traditional Cross-Chain Systems

Many existing protocols such as LayerZero, Axelar, and Wormhole provide messaging or validation services across chains. These solutions often rely on relayer networks, PoS validators, or zero-knowledge proofs to verify transaction data between chains. While functional, these approaches generally require liquidity replication or wrapping assets, introducing smart contract risk and composability limits.

THORChain, a leading cross-chain swaps platform, employs HTLCs and native asset pools to perform trustless swaps between assets like BTC, ETH, and AVAX. However, it requires heavy liquidity provisioning and faces scalability trade-offs.

Alpha differentiates by enabling native staking and composable value representation across chains without token transfers, acting as a liquidity UX layer rather than an intermediary protocol. Its internal accounting model functions like an interoperability protocol built on deterministic smart contract escrows, not external relayers.

Security and Governance Considerations

Security remains paramount in cross-chain design. Alpha reduces attack surfaces by removing pooled liquidity and bridge contracts altogether. All assets remain within their origin chain, governed by verifiable and immutable smart contracts.

Alpha’s proof-of-stake validator compatibility ensures that escrow creation and point issuance reflect the real economic weight of staked capital, while its sybil-resistant design prevents spam and exploitation.

This contrasts with bridge-based models that rely on economic assumptions about validator honesty or cross-chain finality guarantees. Alpha’s approach reduces systemic interdependence and aligns incentives with network security directly.

Cross-Chain Liquidity in the Multi-Chain Future

As more blockchains gain traction, liquidity fragmentation will intensify unless addressed by protocols that abstract complexity and coordinate value across ecosystems. The long-term trajectory of decentralized finance and Web3 applications hinges on the ability to operate across multiple networks efficiently and securely.

- Cross-chain swaps will become standard for asset reallocation across ecosystems.

- Cross-chain liquidity pools will support DEXs with unified depth and routing.

- Interoperability protocols will coordinate not just data, but reputation, collateral, and governance.

- Smart contracts will evolve to invoke functions and manage value across chains.

- Blockchain ecosystems will rely on chain-agnostic infrastructure to support global liquidity movement.

Alpha is positioned as a foundational component of this shift. Its escrow-driven, non-bridging architecture introduces a new category of chain liquid infrastructure that treats capital as composable and value as portable without abandoning security assumptions or user control.

Conclusion

Cross-chain liquidity is not merely a feature, it is a requirement for any scalable, capital-efficient multi-chain future. Protocols that enable secure, composable cross-chain swaps, cross-chain liquidity pools, and cross-chain transactions will define the architecture of decentralized finance over the next decade.

Alpha’s approach (staking-native, accounting-based, and non-bridging) solves key challenges in liquidity movement, without compromising trustlessness or composability. Its model shows how cross-chain liquidity works when designed around security and participation, rather than speculation and replication.

As the ecosystem continues to evolve, solutions like Alpha will become indispensable in building a more connected, efficient, and resilient blockchain economy.